Welcome back. In our last episode, we wrote a neat little scan that utilized the Percent Change syntax to look for an accumulation structure. We wanted a downtrend, stopping action, and then a narrow range of ... READ MORE

Receive all the latest news from Wyckoff Analytics! Weekly notifications about upcoming events, as well as market updates, newly posted articles and videos, delivered straight to your inbox.

Wyckoff Analytics is committed to protecting your privacy. We do not sell, lease or otherwise provide your personal information to anyone, ever. You can unsubscribe at any time from this list.

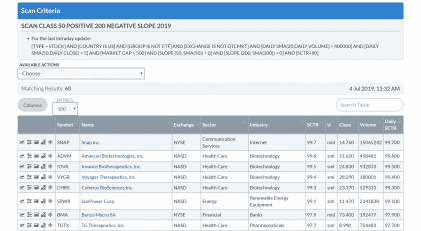

The goal of the Wyckoff Structural Scanning blog series is to help the reader develop scanning skills to search for and capitalize on Wyckoff structural trading opportunities.

From the early days as a corporate bankruptcy and insolvency attorney, John Colucci perused financial statements, budgets and cash flow projections to determine the feasibility of financial plans presented to creditors. After early training in forensic financial analysis and fraud detection, Mr. Colucci took an interest in stock market investing from a fundamental perspective. After a series of hard-taught lessons beginning in 1987, technical analysis became a bigger focus for investment analysis. After working through the quasi fundamental/technical system developed by William J. O’Neil, Mr. Colucci’s Wyckoffian journey began with the search for meaning in the phrase, “the stock is under accumulation.” After numerous books, blog articles, courses and special events with many of the great Wyckoffian’s of our time, Mr. Colucci is primarily a long/short technical stock and futures trader using Wyckoffian principles–with an occasional financial statement sojourn to celebrate old times. Scanning and filtering are particular passions. He has taught the special topic courses Look Less, See More and Scan For Success Part 1 , Part 2 and Part 3.

Welcome back. In our last episode, we wrote a neat little scan that utilized the Percent Change syntax to look for an accumulation structure. We wanted a downtrend, stopping action, and then a narrow range of ... READ MORE

Welcome Wyckoffians! Here we are again pounding away at structural scanning. Enough reminiscing– let’s develop some a scan this time around. Today we are looking at that coding opportunities for stocks ... READ MORE

Accumulation as an expression of Supply and Demand is the menu for the day! When we last me, we looked at Supply and Demand as it shifts during the beginning, middle and end of an accumulation. We looked at trends in ... READ MORE

Welcome back fellow Wyckoffians! In our last installment, we looked at the three (3) laws of Wyckoffian Price Movement. Why? Not just because it’s the law, but because it is how we order our thoughts about ... READ MORE

The materials presented in the Wyckoff Structural Scanning Blogs are for educational purposes only: nothing contained in any of these materials should be construed as investment advice of any kind. REGARDLESS OF ANY LANGUAGE IN ANY WYCKOFF STRUCTURAL SCANNING BLOG POST, NEITHER THE WYCKOFF STRUCTURAL SCANNING AUTHOR(S) NOR WYCKOFF ASSOCIATES, LLC, NOR ANYONE AFFILIATED WITH THE LATTER ORGANIZATION IN ANY WAY IS RECOMMENDING THAT YOU BUY OR SELL ANY SECURITY, OPTION, FUTURE, ETF, OR ANY OTHER MARKETS MENTIONED. There is a very high degree of risk of financial loss involved in trading securities. You understand and acknowledge that you alone are responsible for your trading and investment decisions and results. John Colucci, Jr, Wyckoff Associates, LLC, www.wyckoffanalytics.com, Roman Bogomazov, and all officers, staff, employees, and other individuals affiliated with Wyckoff Associates, LLC, and www.wyckoffanalytics.com assume no responsibility or liability of any kind for your trading and investment results. It should not be assumed that investments in or trading of securities, options, futures, ETFs, companies, sectors or any other markets identified and described in these Wyckoff Structural Scanning Blogs were, are or will be profitable.

|

Trade with (not against) institutions!

|