Using Options Strategies

Within The Wyckoff Framework

ON-DEMAND

ON-DEMAND

This Wyckoff Analytics Stock Options Special is a beginner/intermediate friendly course designed to empower Wykcoffians with the knowledge and skills to navigate the world of stock options trading.

Tailored for those new to options, this course aims to demystify the complexities of options, providing a solid foundation for participants to use option trades with their Wyckoff charting and trading.

This 3-session class is taught by veteran options trader and Wyckoffian Eric Cosway, who will explore option strategies that can be used at various points in the Wyckoff Framework. Helping Eric C, Eric HB, a full-time options trader, will also contribute during the three sessions.

Each of the videos has accompanying slides, which can be printed out to allow you to take notes on as you watch the presentations. You will have one full year from the date of purchase to view and review the videos!

Wyckoff Analytics Stock Options Special

Using Options Strategies within the Wyckoff Framework

Using Options Strategies within the Wyckoff Framework

$400.00

This course will help you:

- Reinforce your understanding of options basics (both puts and calls).

- Understand which option strategies fit in the Wyckoff framework.

- Understand the difference between buying and selling options.

- Define appropriate position sizing.

- Calculate risk and reward.

- Minimize the risk of bullish directional positions.

- Minimize the risk of bearish directional positions.

- Test option strategies.

- Navigate the Schwab Thinkorswim option chain and Thinkback platform.

You will learn:

- Option definitions and terminology

- Basic long and short option techniques

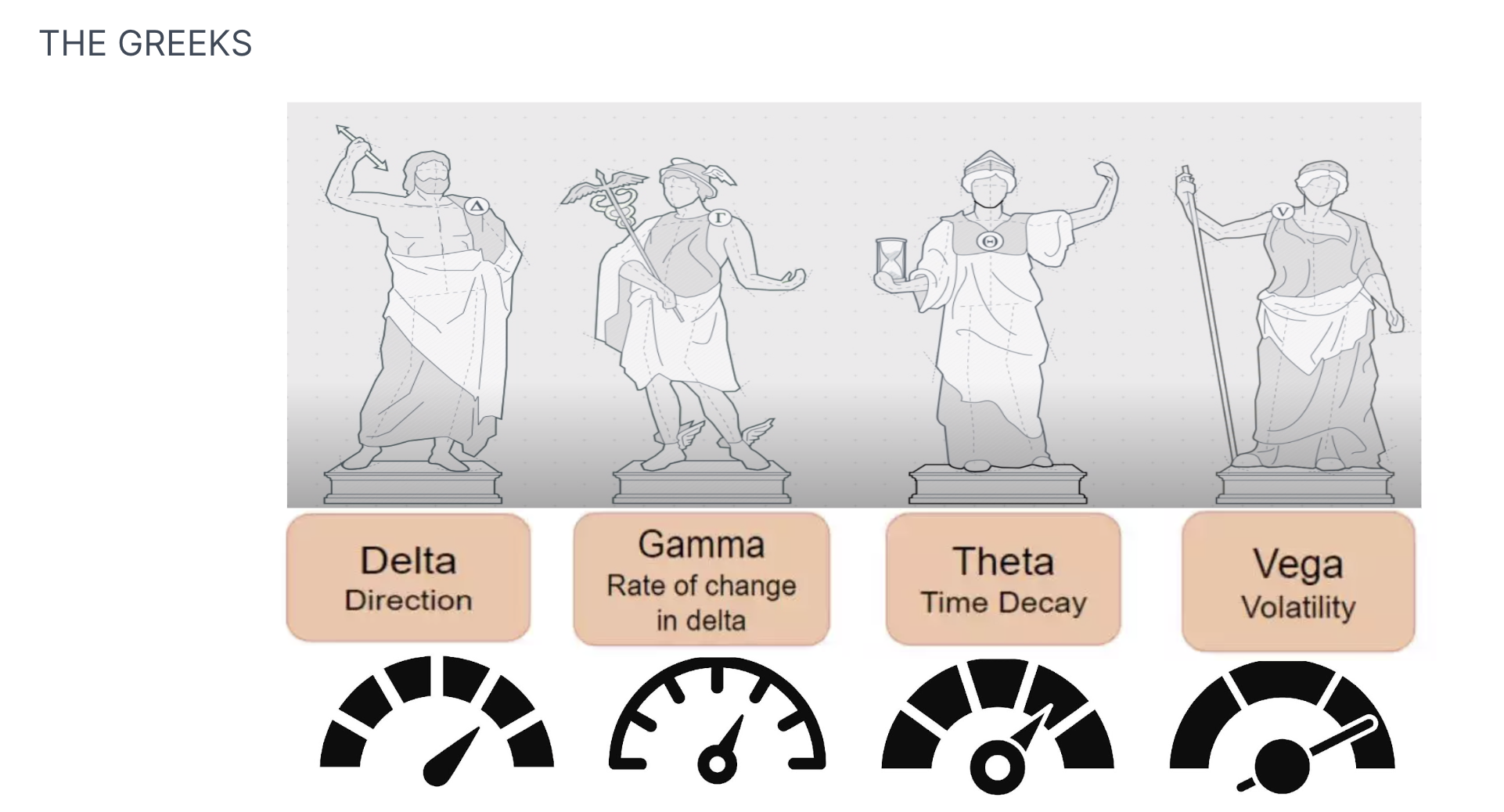

- The Greeks

- Advanced vertical spreads

- Develop a solid understanding of calls, puts, and vertical spreads.

- Learn how to deploy options using the Wyckoff Points of Entry.

- Learn suggested options entry and exit criteria.

- Better understanding of options risk management.

- Learn how to analyze and back-test your options strategies.

Prior to the first session:

Set-up A Free Thinkorswim Paper Money Account

US Students- Open a free Schwab Paper Money Thinkorswim account @

Schwab Thinkorswim

International Students- Open a free 30-day Schwab Paper Money Thinkorswim account via the Guest Pass link.

Thinkorswim Guest Pass

Eric Cosway is a seasoned trader who is deeply rooted in the Wyckoff Analytics Method. Having completed the Wyckoff Trading Course Part 1 and Part 2, as well as Trust the Process, Eric has refined his expertise in market analysis and trading strategies. His active involvement in the Wyckoff Market Discussion, Tape Reading Lab, The Process Group, and his participation at the 2023 Best of Wyckoff conference highlight his commitment to continuous learning and staying updated with the latest in the Wyckoff Analytics Method. In January 2024, Eric taught the popular Charting Essentials course and will teach the June 2024 special topic course, Using Options Strategies With The Wyckoff Framework.

With over seven years of successful trading experience, Eric has concentrated on long-term trading campaigns, investing, swing trades, and short-term options. His trading approach is shaped by his academic credentials, an MBA, and a BCom, which equip him with a robust understanding of business and financial principles.

Eric’s trading philosophy is anchored in the conviction that a comprehensive understanding of market structure, the business cycle, and business fundamentals is the cornerstone of successful trading.

We will send a link for the live GoToWebinar sessions to the email address associated with the user profile established at checkout. You can log in to the GTW sessions from any device that can access the internet. You do not need any special hardware or software to join the webinar. (Please check your junk mail folder for an email from customercare@gotowebinar.com if you don’t see the webinar link within 30 minutes after you’ve subscribed.)

Yes. We try to address all questions about the methodology in depth during each class. Questions about homework assignments are covered in the next class. In addition, each course ends with a final Q&A session to make sure that students have their Wyckoff Method questions answered.

Although you can watch these classes live, it is not necessary to do so. All sessions will be recorded and made available, together with their accompanying slides and homework, through the user profile on the website.

Sign in to the website with the credentials you chose during checkout. Then navigate to the coursework section of your user profile.

If you have any questions email info@wyckoffanalytics.com.

Tailored for those new to options, this course aims to demystify the complexities of options, providing a solid foundation for participants to use option trades with their Wyckoff charting and trading.

Tailored for those new to options, this course aims to demystify the complexities of options, providing a solid foundation for participants to use option trades with their Wyckoff charting and trading.

Tailored for those new to options, this course aims to demystify the complexities of options, providing a solid foundation for participants to use option trades with their Wyckoff charting and trading.

Important Disclaimer:

There is a very high degree of financial risk and loss involved in trading securities. You understand and acknowledge the existence of this risk and also that YOU ALONE ARE RESPONSIBLE FOR YOUR OWN TRADING AND INVESTMENT DECISIONS AND RESULTS. The materials presented and discussed in this online course are for educational purposes only; nothing contained therein should be construed as investment advice. Roman Bogomazov (“Presenter”) is not a registered investment advisor or broker-dealer and does not purport to recommend or suggest any specific trades or investments in stocks, bonds, e-minis, futures, options, currencies or any other financial instruments or markets. Presenter assumes no responsibility or liability of any kind for your trading and investment results. It should not be assumed that any trades or investments described or discussed in this course were, are, or will be profitable.