Long-Term Campaigns

And Tactical Swing Trades Throughout The Price Cycle

ON-DEMAND

ON-DEMAND

This class serves as one of the three elective courses required to complete your certification.

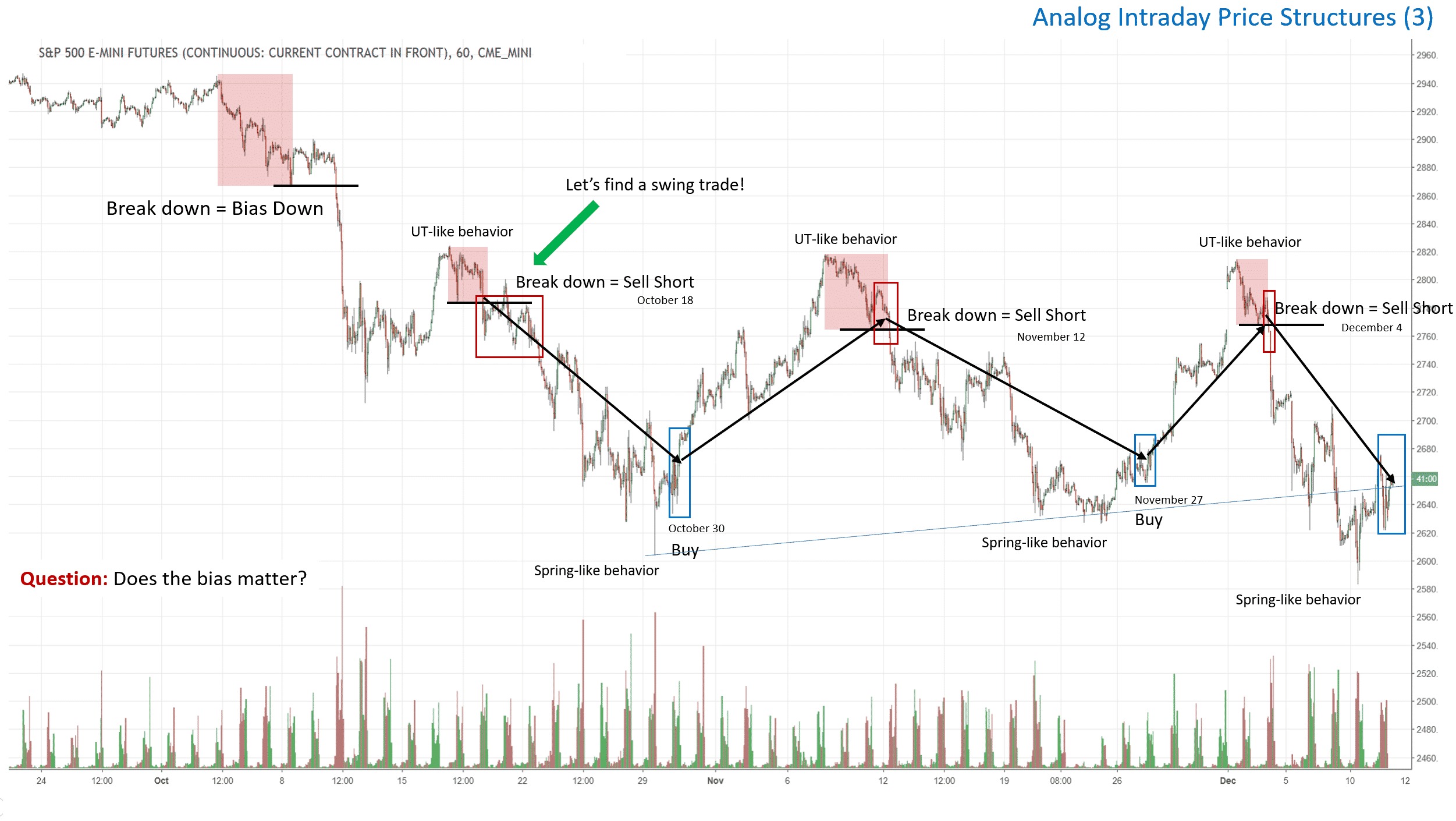

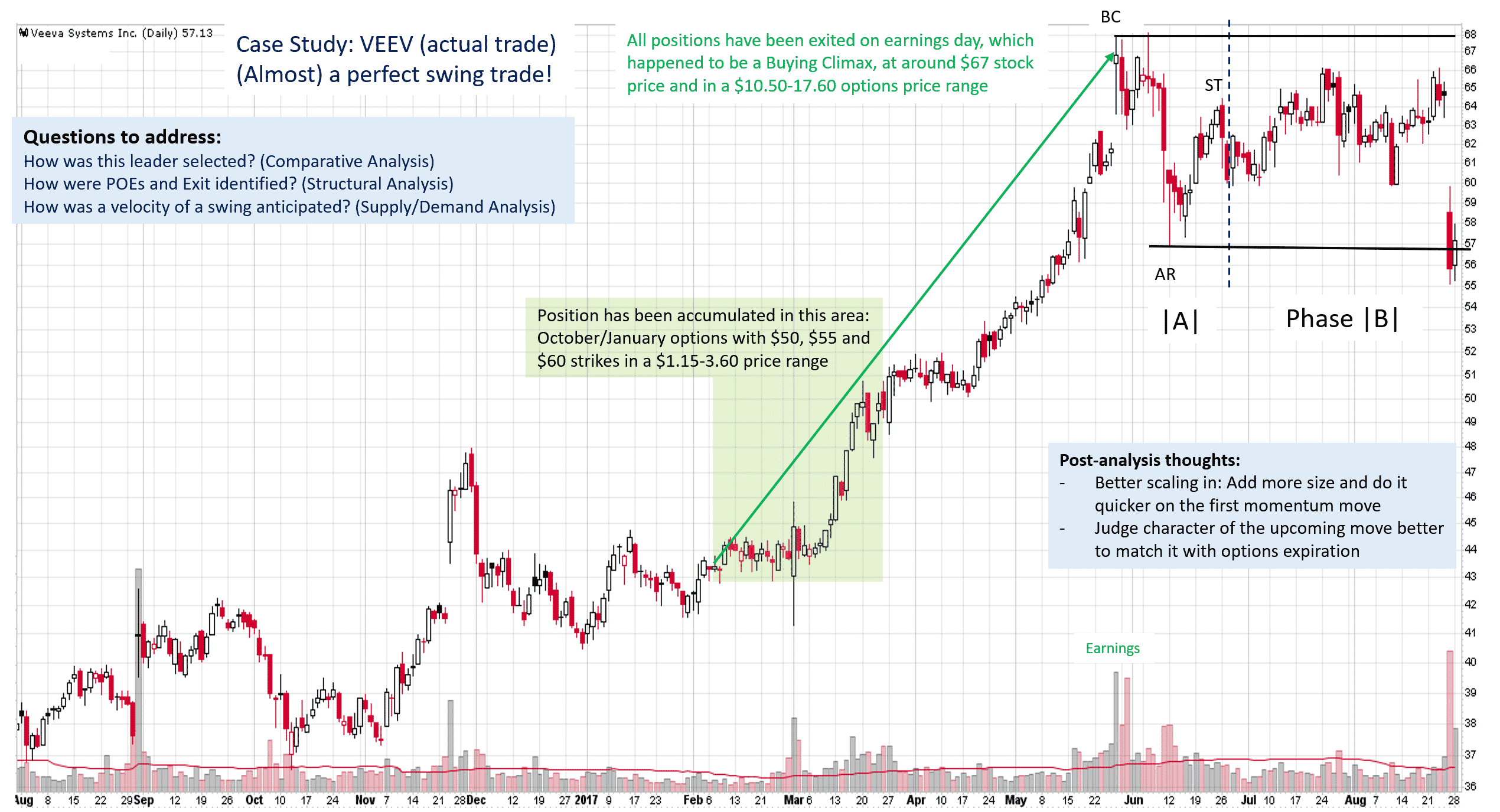

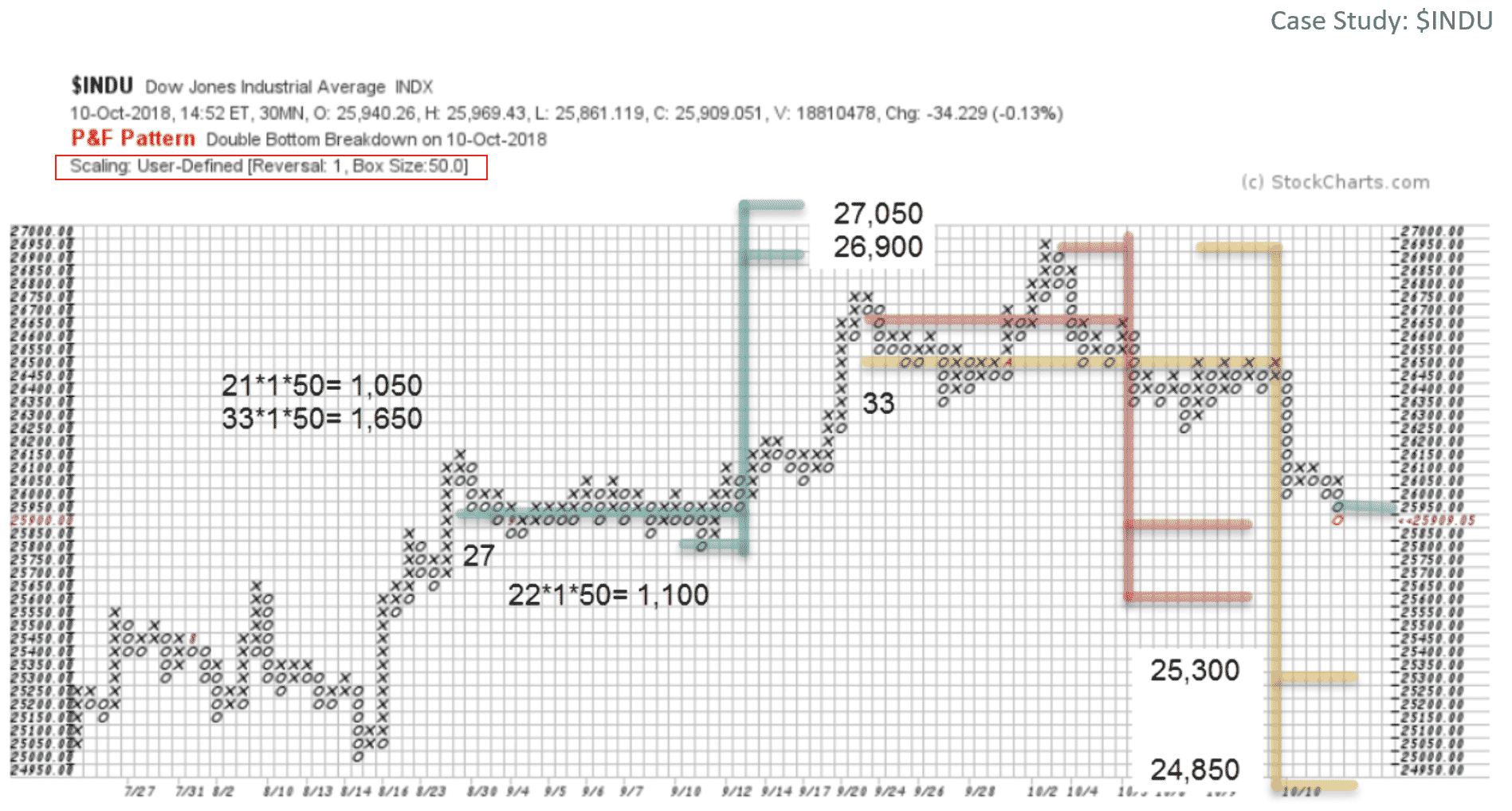

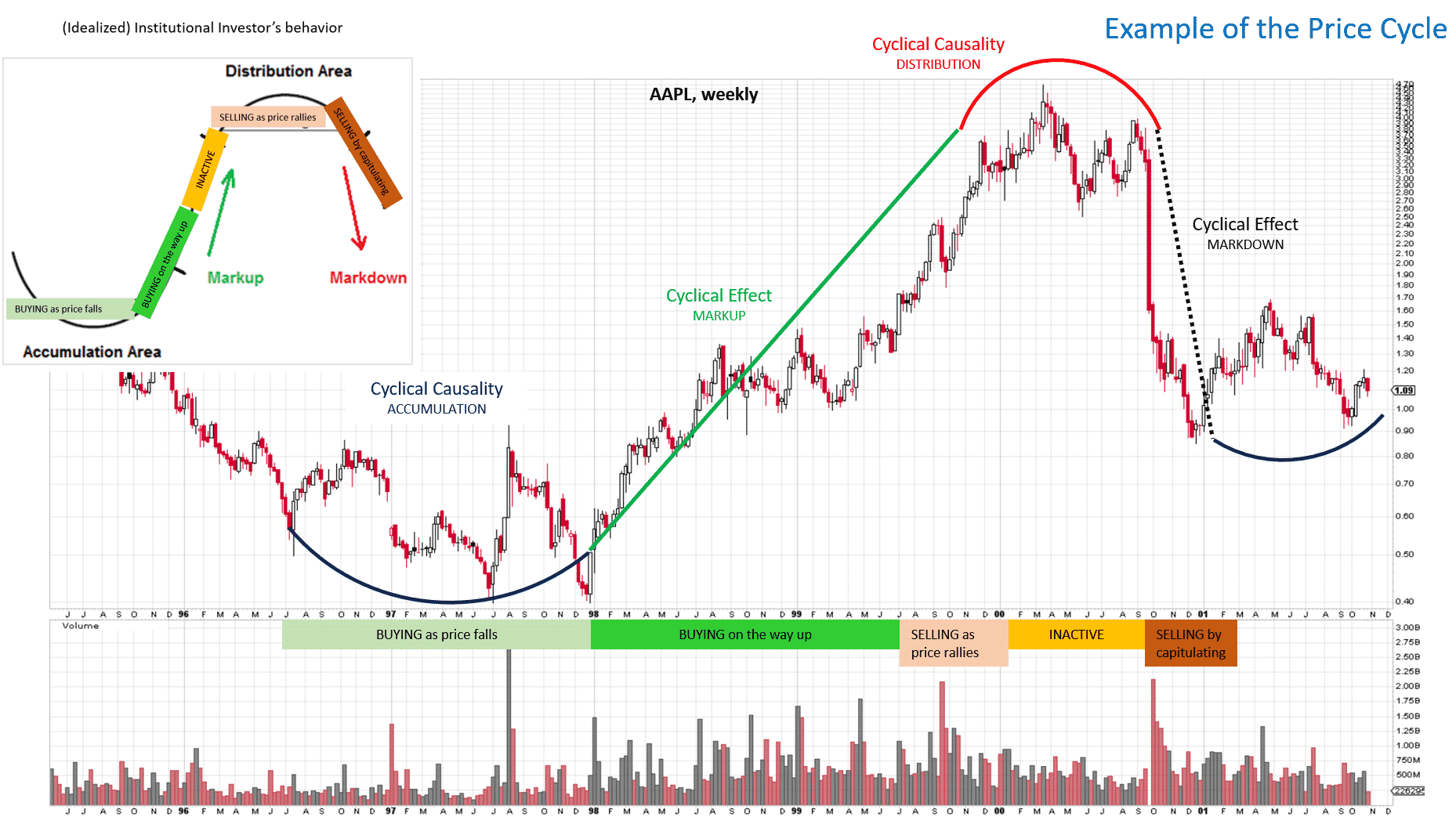

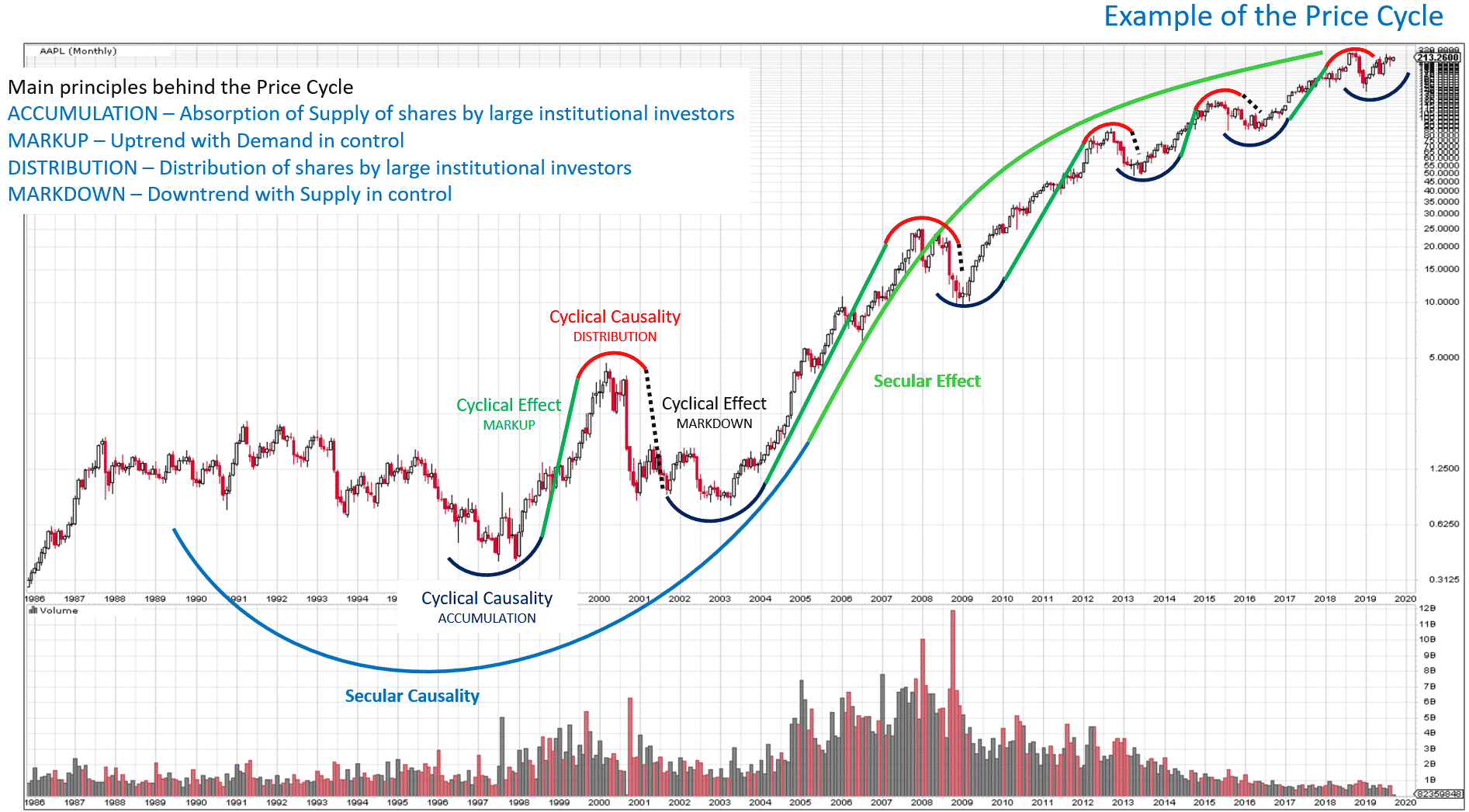

In this long-anticipated series, Roman will describe in detail his approach to long-term campaigns and how he uses swing trades to hedge against his core positions during reactions. Appropriate for ALL LEVELS of students, these three webinars will focus on identifying, in advance, long-term institutional trends as well as trading tactics to deploy during the Price Cycle, focusing on augmenting your total campaign returns with swing trades. This Special represents the culmination and synthesis of the “Intraday,” “Swing” and “Long-term Campaigns” trilogy that Roman has developed and refined over the past five years.

As huge institutions begin to make significant commitments of capital, we can observe a change of behavior in Price and Volume, which is confirmed by the emergence of new momentum and relative out-performance. These tell-tale signs can facilitate our identification and selection of stocks that can produce substantial absolute and relative returns. This Special will provide you with clear guidelines to help you correctly identify directional bias and timing, and to unravel the “mysterious” character of the developing trend, specifically its potential velocity and sustainability.

The main intention behind this Special is to present a highly systematic approach of trading in alignment with “smart” institutional money. Specifically, you will learn how to:

(1) Find the strongest long-term campaign candidates,

(2) Trade them for the long haul,

(3) Capitalize on short-term swings and hedge against your core position, and

(4) Automate parts of the process.

Each of the videos has accompanying slides, which can be printed out to allow you to take notes on as you watch the presentations. You will have one full year from the date of purchase to view and review the videos!

Long-Term Campaigns And Tactical Swing

Trades Throughout The Price Cycle

Long-Term Campaigns and Tactical Swing Trades

$200.00

Session 1: Main Concepts

The Price Cycle revisited

Mapping the Price Cycle

Best tactical trades within a full Price Cycle

Long-term campaign trades

Campaign trade characteristics

Using swing trades to enhance your long-term strategy

Homework assignment

Session 2: Trade Selection

Homework review

Selection criteria for:

♦ Campaign trades

♦ Swing trades

Optimal market environments for long-term and swing campaigns

Homework assignment

Session 3: Illustrative Case Studies, Filtering and Scanning

Homework review

Case study: Assessing the probable sustainability of a trend

Case study: Trading and hedging during market crashes

Filtering and scanning

Long-term campaign scans developed by “Johnny Scan” (aka John Colucci, the presenter for our popular October 2019 Special, “Scan for Success: Prospecting for Actionable Wyckoff Trade Candidates.”

Roman Bogomazov is a trader and educator specializing in the Wyckoff Method of trading and investing, which he has taught for more than ten years as an Adjunct Professor at Golden Gate University and as the principal instructor at WyckoffAnalytics.com. He is the founder and President of Wyckoff Associates, LLC, an enterprise providing online Wyckoff Method education to traders throughout the world (www.wyckoffanalytics.com). Using WyckoffAnalytics.com as a thriving trading community platform, Roman has developed a comprehensive educational curriculum covering basic to advanced Wyckoff concepts and techniques, as well as visual pattern recognition and real-time drills to enhance traders’ skills and confidence. A dedicated and passionate Wyckoffian, he has used the Wyckoff Method exclusively for his own trading for more than 25 years. Roman has also served as a Board Member of the International Federation of Technical Analysts and as past president of the Technical Securities Analysts Association of San Francisco.

We will send the URL and password for the class webpage to the email address you used for the PayPal checkout. If you would like to use a different email address for class communications, notify us at wyckoffassociates@gmail.com.

We use Paypal to process payments; you may pay for courses using your PayPal account or your credit/debit card.

Wyckoff himself found the method to be exceptionally profitable for day-trading

Trades lasting from a few days to several months

Setting Price Targets Using Wyckoff Point-And-Figure Projections

Important Disclaimer:

There is a very high degree of financial risk and loss involved in trading securities. You understand and acknowledge the existence of this risk and also that YOU ALONE ARE RESPONSIBLE FOR YOUR OWN TRADING AND INVESTMENT DECISIONS AND RESULTS. The materials presented and discussed in this online course are for educational purposes only; nothing contained therein should be construed as investment advice. Roman Bogomazov (“Presenter”) is not a registered investment advisor or broker-dealer and does not purport to recommend or suggest any specific trades or investments in stocks, bonds, e-minis, futures, options, currencies or any other financial instruments or markets. Presenter assumes no responsibility or liability of any kind for your trading and investment results. It should not be assumed that any trades or investments described or discussed in this course were, are, or will be profitable.