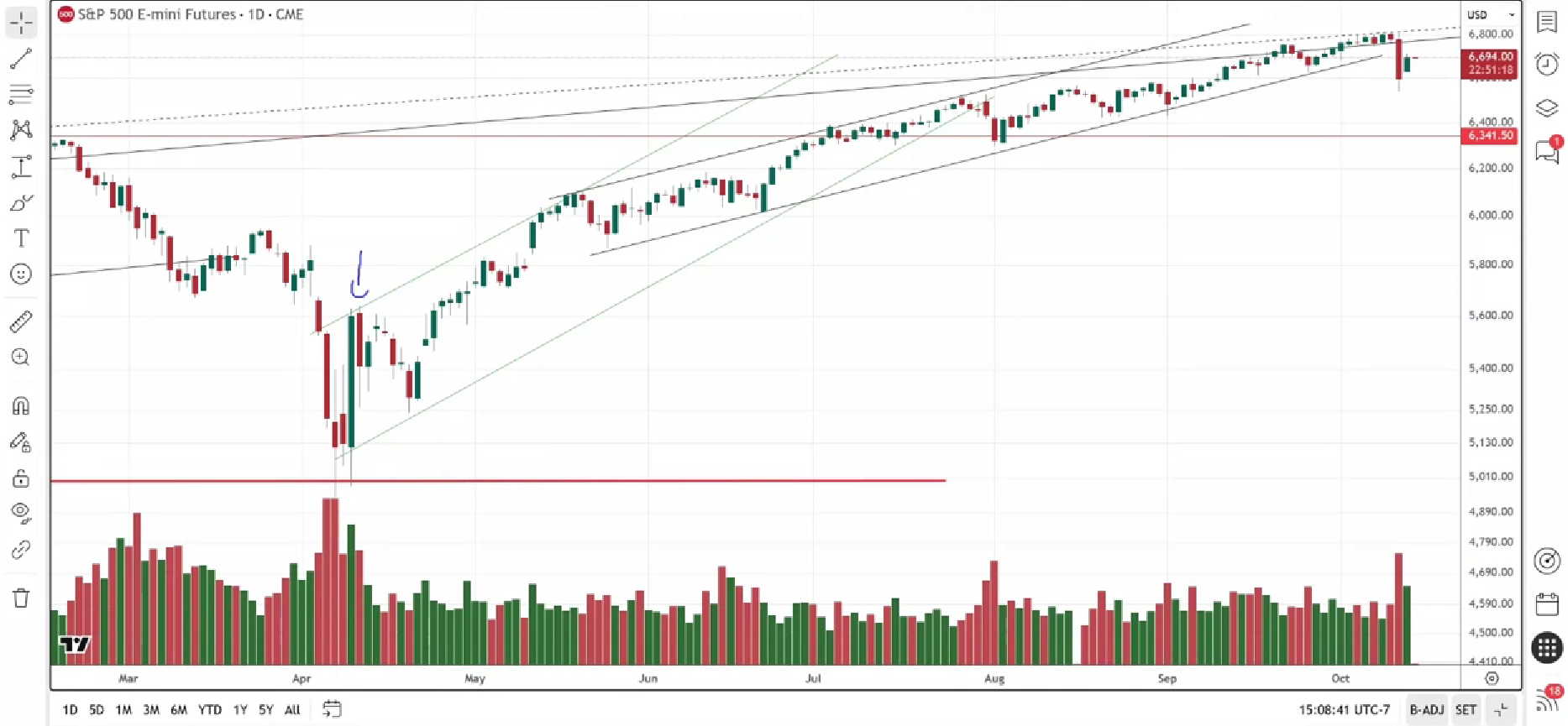

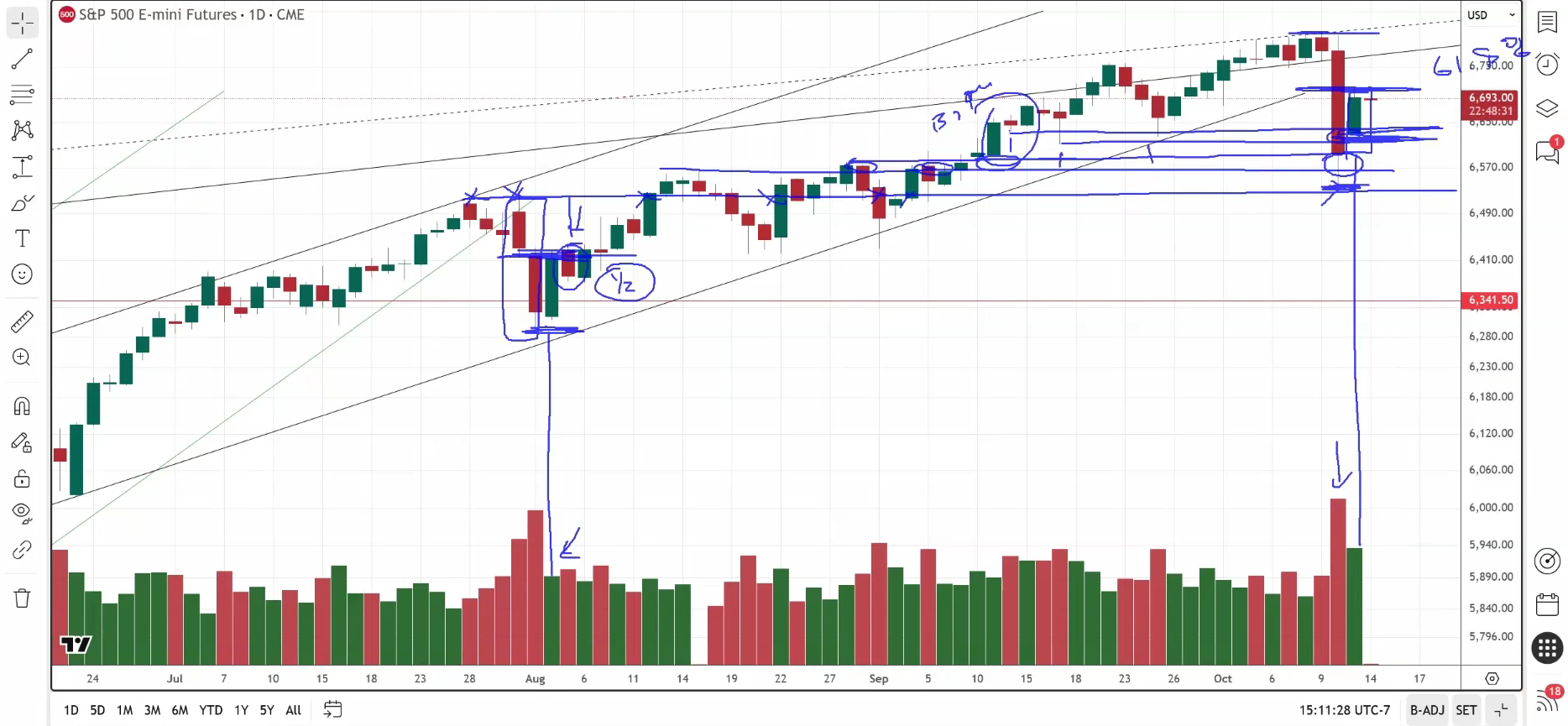

Wyckoff Method

Real Rules of the Game

Live Education

A Path to Mastery

LIVE CORE CLASSES

CURRENT AND UPCOMING SPECIAL EVENTS

ADVANCED SMALL GROUP TRAINING

On-Demand Courses

Study with Experts

Product Catalog

The Complete Guide

Free Materials

Tools for Trading