HYPEUSDT Market Analysis: Leading Crypto Performance and Trading Strategy

HYPEUSDT Emerges as Top Performer in Current Crypto Cycle

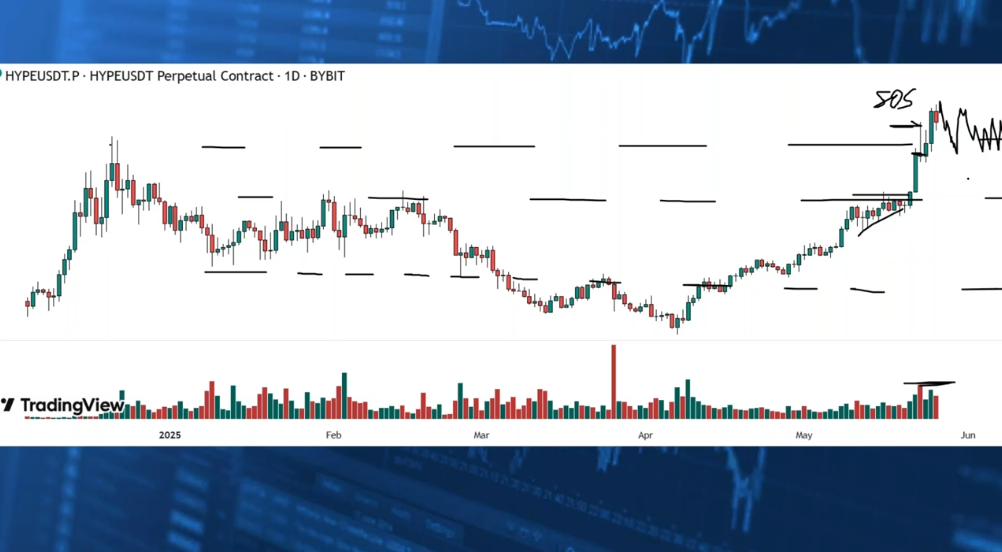

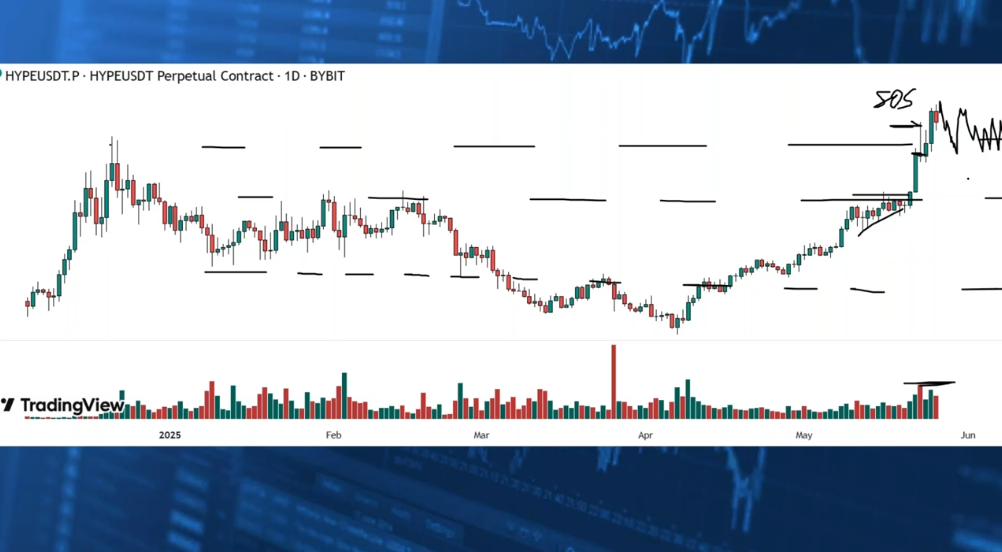

HYPEUSDT has established itself as one of the leading assets in the current crypto cycle, demonstrating exceptional strength that has caught the attention of traders and analysts alike. The cryptocurrency has recently achieved a significant milestone by breaking through its long-term resistance level, marking what appears to be a potential major sign of strength in the broader market context.

Technical Breakthrough Signals Bullish Momentum

The recent price action in HYPEUSDT represents more than just a typical breakout. This cryptocurrency has positioned itself as one of the best outperformers in the crypto space, with its chart pattern showing clear signs of sustained upward momentum. The asset is currently making new highs, a development that reinforces the bullish sentiment surrounding this particular trading pair.

At the current resistance level, market dynamics are playing out as expected. There’s typically some form of supply that enters the market when prices reach these critical levels, and HYPEUSDT is no exception to this pattern. However, the way the asset is accelerating to the upside suggests strong underlying demand that’s overpowering the selling pressure.

Chart Pattern Analysis Reveals Strategic Opportunities

The technical formation visible on the HYPEUSDT chart shows an apex formation that has been followed by a quick resolution to the upside. This type of pattern often indicates decisive market sentiment and can signal the beginning of more substantial price movements.

Current market action shows some supply entering at these elevated levels, evidenced by the supply tail. This development would make consolidation at the current level a logical next step, potentially creating a “major making up action.”

Consolidation Phase Could Present Secondary Entry Point

The potential consolidation at the current resistance-turned-support level could present a second entry point for traders looking to participate in this campaign. This scenario is particularly attractive for those who may have missed the initial breakout or are looking to add to existing positions with better risk management parameters.

Risk Management and Trading Strategy

From a risk management perspective, maintaining appropriate stop-loss levels is crucial in the current environment. The best strategy in the current market environment appears to be following the established trend rather than trying to anticipate reversals or corrections.

Market Outlook and Implications

HYPEUSDT’s ability to break through long-term resistance and maintain momentum above these levels suggests that the overall crypto cycle may be entering a phase where the asset can achieve sustained outperformance.

The combination of technical strength, volume confirmation, and strategic positioning makes HYPEUSDT a cryptocurrency worth monitoring closely. As the consolidation phase potentially unfolds, traders and investors will be watching for signs of continuation or reversal that could influence broader market positioning and sentiment in the cryptocurrency space.

For traders interested in monitoring markets like HYPEUSDT with ongoing weekly analysis, the Wyckoff Trading Course Part 1 Summer semester is currently in progress. This is an ideal time to join the live sessions and receive real-time market insights as these developments unfold throughout the remainder of the course.

This analysis was taken from our Wyckoff Trading Course – Part 1 and is for educational purposes only.

UPCOMING CLASSES & EVENTS AT WYCKOFF ANALYTICS:

The Wyckoff Trading Course – Part 1 (Summer 2025):

The Wyckoff Trading Course (WTC) Part I offers a comprehensive education in the Wyckoff Method through 15 live sessions with recorded access.

This program teaches traders how to identify and follow institutional movements, anticipate market direction through price, volume, and time analysis without additional indicators, and “read the market” effectively. Students learn essential skills in three core areas:

- Price Structural Analysis (recognizing market cycles and institutional behavior)

- Supply and Demand Analysis (using volume-price relationships to predict market moves)

- Relative Strength Analysis (comparing instruments to identify optimal trading opportunities)

The course provides practical tools for trading alongside major institutions that drive market trends, with real-time market analysis and historical chart demonstrations.

Join our flagship Wyckoff Trading Course

The Wyckoff Trading Course – Part 2 (Summer 2025):

The Wyckoff Trading Course (WTC) Part II builds on foundational knowledge through 15 live sessions with recorded access for experienced students who have completed Part I.

This advanced program enhances traders’ pattern recognition and trade management capabilities through three core focus areas:

- Visual Recognition Skill “Practicum” (applying Wyckoff concepts through interactive exercises and drills)

- Advanced Wyckoff Analysis (deepening knowledge of phase behaviors, volume signatures, and trend recognition)

- Trading Tactics and Management (learning to visualize price structure scenarios, optimize entry/exit points, and implement risk management techniques)

The course emphasizes deliberate practice to help traders anticipate market direction, identify institutional players’ movements, and execute more profitable trades with greater confidence.

Students learn to select optimal trade candidates and use Wyckoff analysis alongside modern technical analysis tools for improved trading decisions.

Join the Wyckoff Trading Course – Part 2

Wyckoff Analytics Summer Training:

The Wyckoff Analytics Summer Training Course offers a 4-week introduction to professional trading techniques through four live interactive sessions led by experienced traders Roman Bogomazov and Tony Nguyen.

This program serves as a preview of their comprehensive Intraday and Swing Trading Program, helping traders develop a structured approach to market analysis.

Students learn essential skills in

- Process & Playbook Development (building a personalized trading framework)

- Post-Trade Analysis & Review (objective self-assessment)

- Technical Training (applying Wyckoff principles to identify trading opportunities)

- Simulation & Practice (risk-free application of skills).

The program creates a supportive learning environment where traders can learn from seasoned traders, develop disciplined decision-making processes, engage with a community of like-minded individuals, and gain practical experience that translates to real-world trading.

Join the Wyckoff Analytics Summer Training

Demystifying Position Sizing: Optimizing Risk And Reward:

The “Demystifying Position Sizing” course offers a transformative learning experience focused on optimizing risk and reward strategies with RJ Hixson, former Vice President at the Van Tharp Institute.

Students will learn four key components:

- The Missing Link to Profitability (understanding position sizing’s crucial role in achieving money objectives)

- Master R-Multiples (calculating and implementing risk measurement tools)

- Optimize Risk-Taking (using Expectancy and System Quality Number to inform decisions)

- Practical Position Sizing Strategies (implementing proven approaches that align with specific trading goals)

Join Demystifying Position Sizing: Optimizing Risk And Reward